Part 1 - Zooming Past the Finish Line: The Rise of Nike

From Waffle Irons to Billion-Dollar Swooshes: Tracing Nike's Trailblazing Journey in Sports and Fashion

“Let everyone else call your idea crazy... just keep going. Don’t stop. Don’t even think about stopping until you get there, and don’t give much thought to where ‘there’ is. Whatever comes, just don’t stop.”

Phil Knight

Before we start:

This is the first part of a two-part series. Despite its length, it offers valuable insights. I've put a lot of research into it, and I'm eager to hear your thoughts.

Introduction

How is it possible to be a shoe company that does over $50 billion in revenue when they technically don't make a single shoe?

Nike is arguably the most iconic and successful brand of our time. On any day, more people wear the swoosh than any other shoe logo by a significant margin.

If you've read Shoe Dog or seen Air, you might think you're familiar with its history. However, Shoe Dog concludes in 1980, and Air is better described as a captivating piece of fiction. The true story, as it often happens, contains even more drama, unexpected developments, and valuable business insights than those narratives.

So, put on your Vaporflys, Air Maxes, Dunks, or Jordans, and let's dive in!

Context: How Big is Nike?

Here are some exciting facts to show you just how massive Nike is:

Shoe King: Nike isn't just a big fish, it's the whole whale in the footwear industry. They control over 53% of the global athletic footwear market, leaving Adidas (their closest competitor) trailing at 23.3%.

(Source: Statista, 2023)

Brand Powerhouse: Forget fancy buildings, Nike's Market Cap is worth a staggering $142.16 billion (as of April 2024). That's true heavyweight status! To put this in perspective, it's more than the combined market cap of Under Armour ($5.3 billion) and Lululemon Athletica ($44.5 billion).

(Source: Companies' respective Investor Relations websites, April 2023)

Sales Powerhouse: Sales figures reflect the true scale of a business. In FY2023, Nike generated an impressive $52.44 billion in sales, significantly outperforming Adidas' $26.366 billion and Puma's $8.2 billion. Nike's dominance in the sales arena is evident as well.

(Source: Companies' respective Investor Relations websites, FY2023 Reports)

The Origin Story: Starting from the bottom now we here

1955 University of Oregon

Our narrative begins at the University of Oregon, the breeding ground for what would become a global sports colossus. Here, track coach Bill Bowerman emerged as a pioneering figure, casting a long shadow in American athletics. Not merely content with coaching the nation's first sub-four-minute milers, Bowerman's impact was profound as he shaped the capabilities of numerous Olympic teams.

Enter Phil Knight, a middle-distance runner majoring in journalism. Phil would describe himself in his prime as an okay runner; after all, Knight was pacing alongside the nation's crème de la crème, tutored by none other than Bowerman himself. Yet, clocking a 4-minute and 13-second mile, Knight was not only an okay runner, but he would also be a star in any other school.

Diving headlong into innovation, Bowerman was an above his time— a visionary sculpting the athletic space. Renowned as the first to earnestly rest in training regimes, he didn't stop there. He donned the mantle of a cobbler, deconstructing conventional Adidas sports shoes and re-engineering them from scratch. His team of athletes became willing participants in his quest for tennis shoe innovations, seeking even the slightest competitive advantage, with the shoes acting as a canvas for his technical ingenuity.

Contrary to widespread belief, the relationship between Bowerman and Knight was not forged from a profound mentor-mentee bond. Knight represented a single strand in the broader fabric of Bowerman's team, personifying unrealized potential rather than a distinguished favorite.

Phil Knight is the second from right

1962 Stanford Graduate School of Business

As Phil Knight waved goodbye to his undergraduate years, he ventured into the halls of Stanford's Graduate School of Business, ripe for his next academic chapter. Amidst the cluster of eager minds at Stanford GSB, Phil's path took a significant turn during his final term, thanks to Professor Frank Shallenberger. The task at hand — to ideate and articulate a business idea.

Crafting his paper, Phil drew upon his journalism insight and his familiarity with the photography department back in Oregon. He outlined a shift in the camera industry, where high-quality yet cost-effective Japanese brands like Nikon and Fuji were disrupting the German-dominated space with affordable alternatives.

Behind The Deal Comment: This is an example, The first picture is a German Camera, the Praktina FX from 1953, which was the first SLR camera, designed for professionals. While, the second picture represents the Nikon SLR from 1959, which was the first Nikon SLR camera.

Much like cameras, the sporting running shoes landscape was also monopolized by German giants, with Adidas leading the charge. Phil's paper boldly suggested that the Japanese model of disruption could pivot the sports gear world towards a similar revelation.

However, the reception was tepid at best. The classmates and faculty did not share Phil's enthusiasm. They didn't think the paper was bad, but neither did they consider it the best business idea. Ultimately, Phil's business proposal was simply to apply Japanese low-end disruption to the athletic apparel market and footwear market which was not that big nor important.

Behind The Deal Comment: It's important to note that in the 1960s, running wasn't popular; it was mostly an activity athletes engaged in to supplement their training. It's nothing like today, where if you step outside at 7:00 am, you'll see plenty of people running. In the words of Phil Knight: "In 1965, running wasn't even a sport. It wasn't popular or unpopular; it simply existed. Going out for a three-mile run was something only weirdos did, presumably to burn off excess energy. Drivers would slow down, honk their horns, and yell 'Get a horse!' while throwing a beer or soda at the runner's head."

1963 Tokyo and Kobe, Japan

Post-graduation life for Phil was full of uncertainties. So, he decided to travel a little before real life starts—a "what's next?" quest that first took him to Hawaii with a Stanford GSB buddy. But soon, the call of individual discovery ushered him alone to Tokyo, Japan, where echoes of his business school paper rumbled in his mind.

Intrigued by Japanese athleticism, Phil found himself frequenting Tokyo's tracks, eyes keenly observing the runners' choice of footwear. Time and again, one brand caught his attention: Tiger running shoes. They weren't just popular; they were everywhere. Driven to know more, Phil did his research and discovered Tiger's brand creator—Onitsuka, with headquarters in Kobe, a stone's throw from Osaka.

Behind The Deal Comment: This are the Onistuka Tiger Spring Up Training Shoes from 1958, something similar to what Phil saw on the Japanese tracks.

Fueled by an impassioned resolve, Phil knew what he had to do. A train journey from Tokyo to Kobe. It was time to meet Onitsuka's management—time to turn an insightful paper into palpable reality.

Behind The Deal Comment: Envision a 25-year-old man approaching the headquarters of a company with a proposal to distribute their product across the globe. This illustrates the depth of Phil's passion for his idea.

Phil, armed with nothing but his Stanford business paper and a conviction as sturdy as his resolve, arrived at Onitsuka's doors presents himself as an American businessman. With a vision to bring Japanese running shoes to US, Phil confidently presented his proposal, citing insights from his academic paper.

In a spur of the moment, Phil introduced 'Blue Ribbon Sports' as the name of his company. The origin of the company's name remains cloaked in varying tales, but regardless, 'Blue Ribbon Sports' became the freshly minted face of Phil's ambitions.

An agreement was struck, and Phil left with the hope of samples being shipped to his home—a test for their potential in the American market.

However, euphoria gave way to silence as months rolled by in Japan without a sign of the shoes. Returning home, Phil faced the stark reality that the samples were amiss, an unnerving quiet that beckoned him to a different starting line—studying for CPA licensure.

But fate had a different run charted for Phil, and late in 1963, nearly two years later, the samples arrived. He was right; they were precisely the value proposition he remembered—not exemplary in quality, but perfect in price.

Phil promptly reached out to Onitsuka once more, securing not just samples but the rights to steer their distribution across America's West Coast, as the East was already claimed.

1964 The Starting Line of Blue Ribbon Sports

In 1964, Phil Knight made the leap. Leaving his job behind, he embraced the role of pioneer, becoming the voice of Tiger Onitsuka running shoes on the West Coast. Despite the title, the path was not paved in gold; his funds were limited, certainly not vast enough to open a store or even to stock up for wholesale to other retailers. With just enough capital to secure a modest inventory, Phil's new office became the trunk of his car.

And so, Phil hit the road, turning each track meet in Oregon and beyond into a marketplace. His car, packed with potential, became a mobile retail outlet.

One day Phil was struck by a brainwave. He envisioned a partnership that could elevate his venture - why not involve his former coach, Bill Bowerman? After all, Bowerman had an eye for innovation and a shared discontent with the running shoes provided by leaders like Adidas. In those days, university athletes had to equip themselves, as sponsorships and brand endorsements were not yet the norm.

Phil approached Bowerman with a proposition to use Tiger brand shoes from Japan for his athletes, since he thought it would be a great marketing for the shoes. Not only was the response positive, but Bowerman also saw an opportunity so appealing that he proposed a partnership—a bold move to go halves with Phil, 50/50.

Behind The Deal Comment: Consider the stunning nature of the agreement today— a VC securing a 50% stake without investment! It might seem unthinkable. And you may be thinking, why would Bowerman agreed so easy, as historical letters and records from the University of Oregon and Nike archives reveal, he had been engaging with big industry names like Adolf Dassler (The short for Adolf is Adi, so yes he was the founder of Adidas) for years. He wasn't just looking to get quality shoes at no markup for his athletes; He made it clear he had ideas on how to make running shoes better. So that is why Bowerman was so excited about this opportunity.

For Phil, partnering with Bill Bowerman was a no brainer. By aligning with Bowerman's influential status and valuable network, Phil positioned himself to harness a wealth of resources and credibility. It was an opportunity too golden to pass up—for who better to endorse running shoes than one of the era's most recognized track coaches?

Both invested equally—$500 each—to secure their first big shipment of Tigers from Onitsuka. Knight, faithful to his original game plan, hit the road. He journeyed from one track meet to another, selling from the trunk of his car.

The reception was as swift. The inventory sold out in the blink of an eye, providing Phil and Bowerman with the capital to double down on their next orders. They made $8,000 in revenue in the first year and double it to $16,000 the next one.

Behind the Deal Comment: Let's spotlight some pints about Nike’s inception:

Nike, as a brand, hadn't yet taken form.

The iconic Swoosh was nowhere in sight.

The business plan was to import and sell another company's running shoes.

However, I can imagine you can see a problem here; profits were slim, and they were mostly used back into purchasing more inventory. In 'Shoe Dog,' Phil reveals the modest earnings of approximately $2 per shoe sold—He was selling each shoe in $6.95 and it cost him $3.5 to import each shoe, so he has a 50% gross margin. In other hand a full $1.75 per pair went to their salesman, Jeff Johnson, who would later become a Nike historian, as a commission, consequently, a great portion of their Gross Margin was devoured by sales and marketing expenses. This arrangement left them with a narrow slice of the profit pie.

Blue Ribbon Sports' growth trajectory was hinged on securing adequate financing. With regulations confining corporate banking within state lines, options in Portland, Oregon, were scant, restricted to a mere handful of regional banks.

Behind the Deal Comment: We should underscore a pivotal financial principle here—banks demand repayment with interest, not equity stakes.

However, Phil Knight's encounters with bankers unfolded a narrative of caution over ambition. The local financial institutions were averse to risk.

Knight recalls the paradoxical viewpoint of his banker: A seismic 100% sales increase wasn't cause for celebration but a red flag signaling disproportionate growth relative to the company's equity. Thus ensued a dialogue of contrasts, where Knight's vision of incessant growth clashed with the banker's conservative definition of stability.

In essence, the banker's rigid stance was akin to offering a cash advance matched to existing assets. This model, now is mirroring factoring in nature, severely throttled Blue Ribbon Sports' potential to scale.

Faced with growth constricted by banking bureaucracies, Knight made the pragmatic choice to forego personal remuneration. Instead, he returned to the accounting realm, joining PwC's Portland office by day while nurturing Blue Ribbon Sports by night.

Eventually, Blue Ribbon does become big enough, and he needs to devote enough time to it that he can't be a full-time accountant. Instead, he gets a job teaching accounting at Portland State

Blue Ribbon Sports in the Olympics

The sales graph for Blue Ribbon Sports looked less like steps and more like jumps as the brand lifted off. Year after year, they clung to just enough financing to keep the dream aloft, managing to consistently double their revenue. From $44,000 in 1966 to a whooping $84,000 in 1967, Blue Ribbon Sports was proving that exponential growth was no myth.

With 1967 in the rearview mirror, their sights were set on the 1968 Mexico City Olympics—an opportunity ripe for innovation. Bill Bowerman's influence extended beyond business. His ambition lay in research and development, driven by a desire to create shoes that could redefine performance.

Leveraging his creativity, Phil, and his partnership with Onitsuka, Bowerman pitched an ingenious concept—an athletic shoe that sheds the traditional leather for breezy nylon. The aspiration? To keep runners cool and fleet-footed under the gunning Mexican sun. Onitsuka welcomed the idea, and the gears of innovation began to spin.

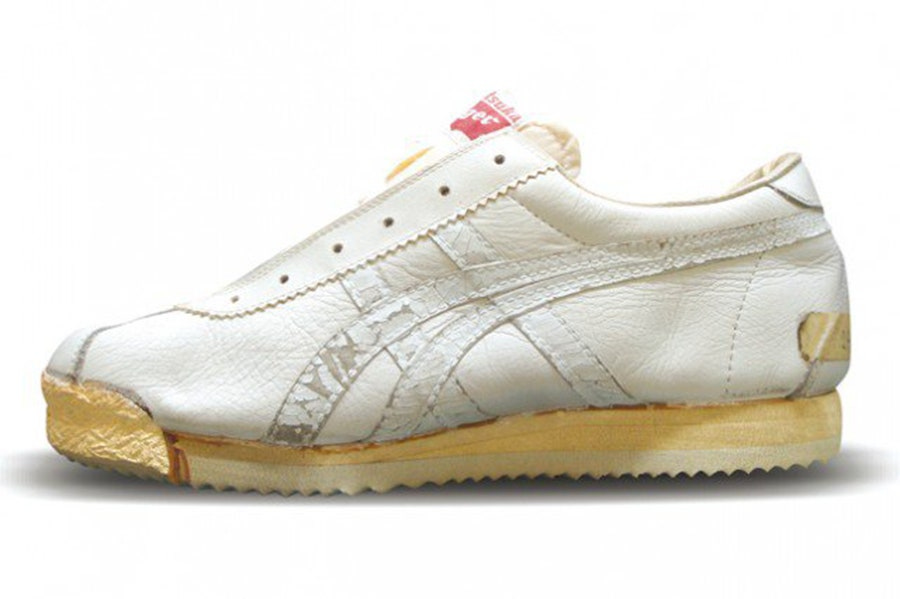

Yet, this collaboration was cresting a wave of complexity. Blue Ribbon Sports wasn’t just an American storefront for Tiger anymore. They were poised to make a mark with their design. Inspired by Adidas' trend of Olympic-themed footwear, they aspired to christen their creation the 'Aztec.' However, Adidas had already snagged the 'Azteca Gold,' prompting a serendipitous twist of fate towards the name 'Cortez'—a last-minute pivot ignited by the historic Spanish conquest.

The Tiger Cortez, adorned with nylon uppers, was not just another shoe; it was an extraordinary hit that cascaded through the alleys of Olympic glory.

Behidn The Deal Comment: Envision the '68 Olympics, entwined with the footsteps of athletes donned in the groundbreaking Tigers—for many, the first Cortez experience. Fast forward to today, and the Nike Cortez persists, a testament to timeless design, still gracing streets all over. It's become a lifestyle shoe and less of a running shoe, because the definition of a running shoe has changed dramatically.

The growth of Blue Ribbon Sports

In 1967, Bill Bowerman not only revolutionized footwear with the Cortez but also sparked a fitness revolution that would sweep across America. While visiting a fellow track coach in New Zealand, Bowerman had a revelation — the practice of 'jogging.' Back in the States, this simple, act of running for health rather than competition was virtually unheard of.

Phil Knight reflects skeptically on Bowerman's ambitions to pen a book about this newfound passion. A book on jogging? To Knight, it seemed far-fetched that there would be an audience.

Bowerman's book, "Jogging: A Physical Fitness Program For All Ages", and his promotion of jogging clubs in Eugene culminated in a Life Magazine profile that set the fitness craze alight. Leveraging Blue Ribbon Sports’ growing distribution network.

As the '70s dawned, Blue Ribbon's sales soared past half a million dollars. They had transformed from a humble startup to a thriving entity, with Onitsuka strengthening their partnership with a renewed agreement.

Knight approached Oregon bankers for a $1.2 million line of credit, armed with ironclad contracts and surging sales. The bankers, conservative and skeptical, didn't share his vision and refused.

This series of rejections underscored the hard truth for Blue Ribbon Sports — growth was not just a target; it was a lifeline. Rapid expansion was the key to staying ahead of debts and maintaining the business. It's important to remember that growth is essential for survival. They will acquire as much product as possible from Onitsuka, despite the factoring debt, and will attempt to sell it as quickly as possible. Essentially, it was growth out of necessity.

Today, this relentless pursuit of growth remains in Nike's DNA. It’s not simply a part of their business strategy; it’s a statement of purpose, resounding as clearly now as it did in those early, energized days of Blue Ribbon Sports.

Behind The Deal Comment: In fact, if you visit Nike's Investor Relations website, you will find the following:

Resolving the Financial issue to grow

Fast forward to 1971, a pivotal year for Nike's genesis. Phil Knight, stumbled upon a game-changing concept. It was about Japanese trading companies—entities that embodied a unique fusion of financial institute and supply chain partner. These firms weren't just conventional lenders; they were strategic partners with an arsenal of resources at their disposal.

Behind The Deal Comment: Imagine them as modern-day private equity or holding companies, offering not just capital but also invaluable connections and expertise to fuel growth. In exchange, they might stake a claim in your success through royalties, equity, and interest, all while ensuring your trajectory aligns with their strategic vision.

Enter Nissho Iwai, a relatively smaller player in Japan's trading landscape compared to giants like Mitsubishi and Mitsui. Yet, their offer to finance Blue Ribbon Sport's entire inventory was a game-changer. In a meeting at their Portland branch office, Nissho showcased their deep-rooted knowledge of Japanese manufacturers, probing Knight with insightful questions about potential partnerships and expansion plans.

For Blue Ribbon, it was a lifeline. Ignored by traditional banks, they were in dire need of capital to sustain their growth momentum. Nissho's intervention not only provided the necessary funding but also hinted at a broader strategic partnership that could tilt the scales in Blue Ribbon's favor.

This basically sets off a whole chain of events that would later get prosecuted in court. Onitsuka, knows what this Nissho relationship is going to mean for Blue Ribbon, and it's not good for them, this will mean that they will meet new manufacturers with the help of Nissho and would end their relationship , so they tried to buy 51% of Blue Ribbon Sports.

A Swoosh is born - The rise of Nike

While Phil Knight was dealing with Onitsuka, attempting to purchase Blue Ribbon Sports, he was aware that they were trying to acquire it at book value, which was virtually nothing, as his equity was tied up in his inventory.

Before giving an answer, and with the knowledge that he now had financial support from Nissho, he recalled that during the 1968 Olympics in Mexico, Adidas had produced soccer cleats with a manufacturer in Guadalajara. This inspired him to consider making soccer cleats himself with them.

Technically, he thinks this won't violate his exclusivity agreement with Onitsuka because Onitsuka doesn't make football cleats. There's a paragraph in the written agreement that gives Phil Knight three years or whatever it is of exclusive distribution. In exchange, he is forbidden from importing other brands of track and field shoes.

He visited the factory in Guadalajara, where he was asked to create a distinctive side design for the cleats, akin to Adidas' three stripes. He then collaborated with Carolyn Davidson, a part-time graphic designer at Blue Ribbon Sports, who was paid $2 an hour. He requested her to conceive a design comparable to Adidas' stripes for the sides of the soccer/football cleats.

She came back with some designs to Phil, Jeff Johnson, and Bob Woodell, who are sitting around. They're like, we got to pick one. They're like, well, maybe, I don't know. This one that looks like a checkmark, maybe is the best of the bunch.

Phil very famously says the line, “I don't love it, but maybe it'll grow on me”. That becomes the swoosh. Carolyn was paid $35 for the swoosh.

Behind The Deal Comment: When Nike became a public company, Carolyn was given 500 shares. Since then, the stock has split seven times, and with the current share price at approximately $100, she would have about $7 million today if she retained those shares.

With the swoosh logo finalized, Nike's inaugural soccer cleats were ready for production. But one crucial question remained: what to name them?

At Nike Headquarters, brainstorming sessions buzzed with energy as ideas flew around the room. From "Dimension Six" to "The Falcon," the team explored numerous possibilities. Yet, amidst the whirlwind of suggestions, it was Jeff Johnson's dream-inspired revelation that captured their imagination.

In a stroke of inspiration, Johnson proposed "Nike"—a nod to the winged Greek goddess of victory.

The debut of Nike's soccer cleats marked a watershed moment in their journey. Despite potential legal hurdles with Onitsuka, Nike pressed forward, ordering 3,000 pairs and swiftly selling them. Rumor has it, even the Notre Dame football team sported these revolutionary cleats.

However, their bold move spelled the end of their partnership with Onitsuka. As the courts deliberated over the agreement's validity.

In a groundbreaking deal, Nissho they agree that Nissho will (1) finance all of Blue Ribbon's financing needs, henceforth, pretty much at a scale that goes all the way up to the moon. (2) Nissho will help Blue Ribbon set up direct manufacturing relationships in Japan, which they do. And then (3) in exchange for all that, Nissho gets a 4% royalty on every shoe that Blue Ribbon sells.

Making this the beginning of Nike!

Conclusion

As we conclude this chapter on Nike's early days, let's reflect on the business insights we've uncovered:

Innovative Partnerships: Nike's strategic partnerships have been instrumental in driving growth and innovation. From collaborating with manufacturers like Onitsuka to securing financing and manufacturing support from Nissho Iwai, Nike has leveraged strategic alliances to overcome challenges and capitalize on opportunities.

Legal Strategy: Nike's legal acumen and strategic approach to contract negotiations have played a crucial role in safeguarding its interests and mitigating risks. From navigating exclusive distribution agreements with Onitsuka to defending its intellectual property rights, Nike has demonstrated the importance of sound legal counsel in complex business dealings.

Financial Management: Nike's financial resilience and agility have been key drivers of its growth and sustainability. Despite facing challenges such as limited access to traditional banking services, Nike has effectively managed its finances, securing alternative sources of funding and optimizing operational efficiency to fuel its expansion.

Looking ahead, our journey with Nike will continue as we explore its remarkable growth, including pivotal moments like the groundbreaking partnership with Michael Jordan and the evolution of its business strategies. Join us in the next part as we delve deeper into Nike's ascent to becoming a global powerhouse, uncovering new insights and lessons along the way.

Until then, keep running towards your goals. Goodbye for now!

Waiting for Part 2 ...